Intel’s “CHIPS Act” Escape Route Under Jeopardy As Biden Administration Poses Reservations

Intel’s “CHIPS Act” Escape Route Under Jeopardy As Biden Administration Poses Reservations

Intel's financial turmoil might become even more troublesome in the future, as Bloomberg reports that the company's "CHIPS Act" escape card may not turn out as intended.

Everyone is aware that Intel's financial situation is currently the worst one in the firm's "56-year" old history, with debts mounting up, projects getting halted, and the markets showing little to no interest in the firm's product portfolio. While this all stacks up, Team Blue is finding a way out of the financial mess with multiple alternative insights; however, Intel has enormous hope in getting the incentives from the US CHIPS Act, but according to a new report by Bloomberg, the Biden administration isn't going to provide Intel with an escape route too quickly.

Intel is expected to receive $8.5 billion in grants and $11 billion in loans under the CHIPS Act, but this is conditional on Team Blue's active progress in establishing semiconductor facilities in the US. But, since Intel hasn't delivered up to expectations, it might be that the US government adds new restrictions for the firm, and according to Bloomberg, negotiations around the impending incentives are ongoing. However, it is disclosed that Intel is insisting upon releasing the associated funds quickly and that the firm has "grown frustrated with what it sees."

Interestingly, neither Intel nor the US Commerce Department has commented on the matter, so it's only a matter of time before the situation concludes. However, Intel isn't relying on just one source of recovery since the firm is said to be in talks, likely selling some parts of its foundry division and halting the construction of its $30 billion German facility. The company is in talks with multiple financial advisors to get out of this mess, but by the looks, the firm will have difficulty coming back on track.

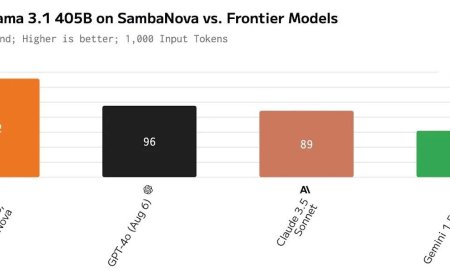

What's next for Intel? The company has been aggressively expanding its consumer portfolio with the releases of next-gen Lunar Lake and Arrow Lake-S architectures, which are expected to be top-tier in their respective market domains. However, Team Blue is still unable to capitalize on the AI hype, and its Gaudi offerings haven't managed to gain sales traction at all, so this particular factor is a crucial reason for why the company's economic growth is going downhill while competitors like AMD and NVIDIA are seeing phenomenal growth figures.

We do hope that the situation improves for Intel moving into the future, and we'll likely see decisive steps being taken by the company after the next shareholders meeting, which is set to take place this month.

What's Your Reaction?