Samsung Foundry’s Revenue Was Higher Than TSMC & Intel In Q2 As A Result of DRAM & NAND Price Hikes

Samsung Foundry’s Revenue Was Higher Than TSMC & Intel In Q2 As A Result of DRAM & NAND Price Hikes

Samsung Foundry has surpassed its competitors, TSMC & Intel, in the semiconductor space as the Korean giant reported quarterly revenue.

Samsung's slight lead in semiconductor quarterly market revenue is as surprising as it may seem, given that for the past few months, we haven't seen much in terms of a breakthrough for the Korean giant's foundry division.

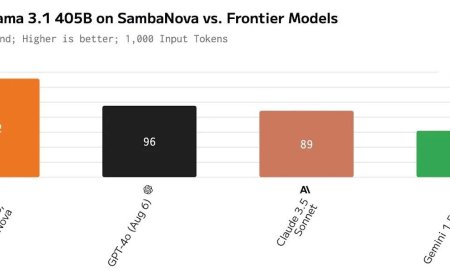

Despite that, the firm seems to have managed to bag higher revenue than competitors like TSMC and Intel. This news comes from the renowned industry analyst Dan Nystedt, who has compiled the figures of Q2 2024 revenue for mainstream semiconductor companies.

Samsung Electronics regained the title of biggest semiconductor manufacturer in the world by revenue in the 2nd quarter (2Q), as it edged out TSMC, the leader for the previous 7-quarters. Intel fell further behind.

Samsung benefited from a rebound in the global memory chip…

— Dan Nystedt (@dnystedt) August 7, 2024

According to data compiled by the analyst, Samsung's chip business managed to generate $20.84 billion in quarterly revenue, and this figure is converted from the Korean won since Samsung reported it in the firm's native language. Along with this, TSMC reported $20.82 billion, marking a slight difference from Samsung, which is indeed negligible in the grand scheme of things, but considering that the Korean giant did take an edge here, highlighting it becomes necessary. Finally, Intel's chip division generated $12.83 billion in Q2 2024, much less than what its counterparts are earning.

Samsung has picked up the pace when it comes to being more competitive in the markets, mainly by getting into mainstream deals and picking up opportunities early on. A prime example of this is how the firm's memory division has been active when it comes to HBM3 and HBM3E qualification for NVIDIA and the progress Samsung made within the span of a few months, being from non-existent in the supply chain to get a key position in NVIDIA's lists of partners. This has indeed translated into the firm being more reliable in the eyes of the industry, hence showing an uptrend in revenue figures.

It would certainly be naive to categorize Samsung's chip business ahead of TSMC based on Q2 2024 results, and more importantly, the gap is negligible.

It's important to note that in terms of operating profits and gross margins, TSMC is way ahead of the markets, and its mainstream 3nm/5nm processes are in hot demand. But we will have to wait and see how the future pans out for Samsung and TSMC, given that competition is stricter than ever.

What's Your Reaction?