DRAM Industry Faces Yet Another Decline, Quarterly Revenue Down By 21.9%

DRAM Industry Faces Yet Another Decline, Quarterly Revenue Down By 21.9%

There has been an abrupt decline in the DRAM market over the previous several quarters, and this trend seems to continue. TrendForce reports that the DRAM market had a severe 21.9% QoQ (quarter-over-quarter) fall, bringing the total revenue down to US$9.663 billion.

This is the third consecutive quarter that the sector has seen a steep drop in sales. Several factors contribute to this downturn, but a prolonged oversupply problem significantly contributes to the continuous price decline. Samsung, Micron, and SK Hynix, the three largest suppliers, reported quarterly revenue declines.

Diving into the numbers, Samsung saw a reduction in shipping quantities and ASP (Average Selling Price) due to fewer orders for its recently released products, leading to a QoQ decrease in revenue of 24.7%, amounting to US$4.17 billion. On the other hand, Micron gained an increase in shipment growth but still suffered the effects of the downturn, citing a 3.8% decline in revenues, bringing its total down to US$2.72 billion. SK Hynix had the most significant loss, with a reduction of over 15% in shipping volume and ASP, resulting in a severe drop in revenue of 31.7%, or around USD$2.31 billion.

In addition to the information on the more well-known suppliers, TrendForce also provided data regarding Taiwanese manufacturers that are now making their way to a more prominent position in the sector.

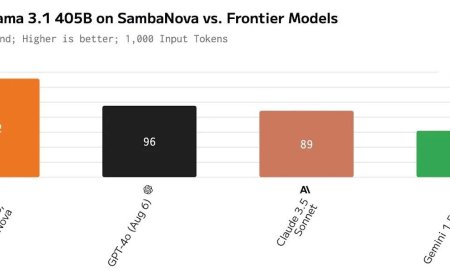

TrendForce has also predicted the revenues of the DRAM industry for Q2, and they don't look good. Here is a look at it below:

TrendForce's earlier prediction of the big three shifting from profitability to loss in 1Q23 due to a swift ASP decline came true. With DRAM prices continuing to fall, it's anticipated that Q2 operating profit margins will remain in the red. In response to this, all three major suppliers have started implementing production cuts, with Q2 capacity utilization rates expected to fall to 77% for Samsung, 74% for Micron, and 82% for SK hynix.

The DRAM market has been consistently in decline due to disturbed demand and supply chains. We certainly hope things turn around, but from the latest economic indicators, the road ahead will be rocky for the industry.

News Source: TrendForce

What's Your Reaction?