Call Buying Activity in NVIDIA (NVDA) Shares Shows a Significant Increase as Investors Bet on Earnings Beat Today

Call Buying Activity in NVIDIA (NVDA) Shares Shows a Significant Increase as Investors Bet on Earnings Beat Today

This is not investment advice. The author has no position in any of the stocks mentioned. Wccftech.com has a disclosure and ethics policy.

NVIDIA (NASDAQ:NVDA), a major manufacturer of graphic cards, is attracting sizable call option inflows amid widespread expectations of significantly upbeat earnings later today.

Even though graphic cards (GPU units) account for the largest share in NVIDIA’s revenue, the company, the company’s data center-focused segment – that manufactures processors for diverse applications, including cloud computing and AI – has been showing phenomenal growth, with some analysts expecting this unit to overtake the company’s gaming segment in the coming quarters. On the flip side, NVIDIA's recent abandonment of its plans to buy the chip designer Arm hammered the stock last week.

Against this backdrop, NVIDIA is expected to report $7.43 billion in revenue later today, as per the consensus expectations of analysts. The company is also projected to report a non-GAAP EPS of $1.22.

Finally, Piper Sandler published a dedicated investment note on the 15th of February, predicting that NVIDIA will not only significantly beat its earnings expectations today but also raise its forward financial guidance. Analyst Harsh Kumar noted:

"We are looking for a significant beat and raise when the company reports earnings on Wednesday after market close, as both gaming and data center continue to perform well ..."

This brings us to the crux of the matter. As of the 15th of February 2021, NVIDIA’s 60-Day Put/Call ratio was recorded at 1.2078, while the 10-day Put/Call ratio hovered at 0.4575. This indicates that the short-term trend is highly skewed toward calls.

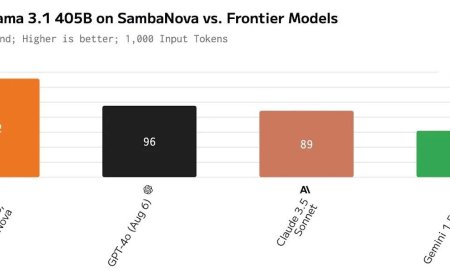

In fact, a cursory look at the two remaining expirations in February showed a distinct tilt toward calls yesterday:

As is evident from the snippet above, 2.24x as many calls as puts were traded yesterday for the 18th February expiration.

Moreover, the call with a strike price of $260 and expiring on the 18th of February attracted exceptional investor interest yesterday, with a daily volume of around 1.8x the contract’s open interest. Specifically, the $260-call recorded a daily volume of 41,165 against an existing open interest of 22,897.

It is no wonder then that NVIDIA shares opened at $249.59 yesterday only to climb over 9 percent during the regular trading session, with the stock closing at $264.95.

What's Your Reaction?