AMD Losing PC Market Space To Intel: Analyst Says Intel 12th & 13th Gen CPUs More Competitive Than Ryzen

AMD Losing PC Market Space To Intel: Analyst Says Intel 12th & 13th Gen CPUs More Competitive Than Ryzen

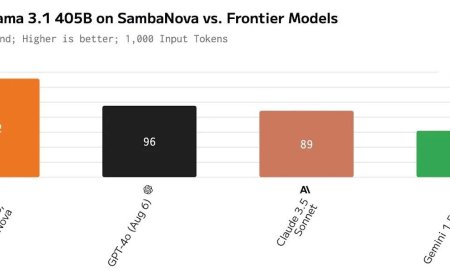

Intel seems to be holding up quite well within the general PC market compared to AMD, as reports investment firm, Susquehanna.

Susquehanna recently upgraded its rating of Intel Corporation from negative to neutral and some of the main reasons highlighted for this upgrade happen to be Intel's highly competitive general PC portfolio versus AMD.

While AMD's Ryzen CPUs have enjoyed several years of dominance over Intel thanks to being very competitive in terms of performance and value, the most recent options seem to be the opposite of what the company had initially planned out. Intel on the other hand is said to have its 12th and 13th Gen CPUs positioned more competitively which will result in PC market share slipping away from AMD.

Now AMD did post an impressive 30% overall x86 market share which was a huge feat for the company but the company is focusing more towards its EPYC server side of things while Ryzen CPUs may now see a downfall in terms of overall market share. AMD recently delayed its Ryzen 7040 Phoenix CPUs for laptops by a month and the company has focused its X3D chips first at premium markets with the Ryzen 7 7800X3D coming a month later too. The Dragon Range CPU lineup also aims at the high-end segment and the only options available for now are the high-end Ryzen 9 7945HX laptops while others are missing despite the company announcing the official availability a week ago.

Regarding Intel (INTC), Rolland said AMD (AMD) looks to no longer be gaining share in the PC space, the Pat Gelsinger-led company has put forth a better product roadmap and executed on it and the hangover in the PC space due to the work-from-home boom during the pandemic and subsequent inventory correction has "run its course."

It's not all fun and games for Intel (INTC), as the company's data center business is seen as a "near-term risk," citing checks in Asia, but the PC business looks to have started to stabilize, which should help the company going forward, Rolland posited.

Susquehanna via Seeking Alpha

If you look at AMD's AM5 platform, the company has no SKUs under the sub $250 US price range whereas, Intel has offered several SKUs under that range and their platform cost also remains far more attractive. Meanwhile, AMD's AM4 platform remains dominant in terms of sales with Ryzen 7 5800X3D still selling like hotcakes despite the launch of newer X3D chips and the company offering several incentives, promos, & discounts via its retailers to sweeten up the AM5 platform for users.

However, all isn't great for Intel (yet). The Chipzilla's recent Sapphire Rapids-SP will be facing brutal competition against AMD's EPYC Genoa, Bergamo, and Genoa-X CPUs, all of which will be shipping this year, The Emerald Rapids-SP will be the planned follow-up to Sapphire Rapids-SP but will only be shipping to 1S / 2S platforms by the end of this year.

Despite that, Intel has stated that they have received strong customer adoption for its lead server products with 450+ design wins, 200+ designs already shipping, 50+ major OxMs shipping & the top 10 global CSPs deploying now & throughout 2023.

What's Your Reaction?