AMD Achieves Huge Server Milestone As EPYC Chips Exceed Opteron’s Market Share

AMD Achieves Huge Server Milestone As EPYC Chips Exceed Opteron’s Market Share

It took a while but AMD's server segment has delivered on its promise of getting past the historical highs set by their previous Opteron chips thanks to the latest EPYC CPUs.

Almost three years back, AMD set a goal to achieve not only a 10% market share by 2020 but also to hit the historical high of 26% that was once amassed by its older Opteron CPUs. Within 5 years, the company not only achieved its first goal but its latest EPYC CPUs now amount to an x86 server CPU share of well over 25%.

Our first generation of EPYC was called Naples, and just this August, we launched our 2nd Generation, codenamed Rome. We're at about 7% share today Tim, if you look at the IDC TAM of about 20 million units.

We also are -- it’s our goal over time to get back to the historical levels which was 26%. But before we have credibility in such an aspirational goal, we need to get to double-digit share first. So, our target is to get to 10% share by the second quarter of 2020.

Ruth Cotter, SVP of Worldwide Marketing, HR & IR at AMD - Seeking Alpha

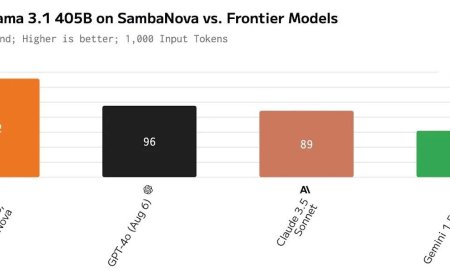

In a recent publication by Next Platform, it is revealed that market analysts such as Gartner, IDC, and Mercury Research put AMD's server market share which mainly comprises its EPYC server CPUs about north of 25%. That's a huge victory for AMD's server segment which has continued to disrupt the market with strong offerings and even displaced the one mighty Intel whose Data-Center division lost a big chunk during the latest quarterly earnings.

The best guesses across the Wall Street people that we talk to (who have access to Gartner, IDC, and Mercury Research server data) are that AMD has about north of a 25 percent share of server sales right now across all server sizes and types, which means Epyc has finally outdone Opteron.

via The Next Platform

While Intel's Datacenter and AI Group (Xeon CPUs) was down 16% year-over-year, AMD's Data Center Revenue shot up by 83% year-over-year. With more and more customers inclining toward AMD's EPYC CPUs such as Rome, Milan, and Milan-X, the company has been able to completely change the server landscape. They may still hold a quarter of the entire x86 server CPU share but given that it's been just five years since the release of the first EPYC chips, this is a huge milestone.

I think the portfolios are continuing to expand. We're excited about not just the current portfolio, as you said, with Genoa, but as we expand to Genoa X at the very high end of the performance as well as Ciena that just broadens our portfolio for telco. So our expectation is that we continue to steadily grow share in the enterprise, as well as we go through 2023 and beyond.

Genoa has much more content than Milan, right? If you think of Milan, it's Rome and Milan are 64 core processors. And as you get into Genoa and Bergamo, you get to 96 and 128 cores. So you would expect on a per unit basis that the ASP would go up.

From what we see today, again, there is a strong customer pull on Genoa.

AMD CEO, Dr. Lisa Su (Q2 2022 Earnings Call)

And with more delays hitting Intel's Sapphire Rapids Xeon CPUs, AMD's next-gen EPYC lineup such as Genoa, Bergamo, and Genoa-X may end up pulling even more customers. AMD's CEO, Dr. Lisa Su, has already hinted that this is indeed what is happening right now.

What's Your Reaction?